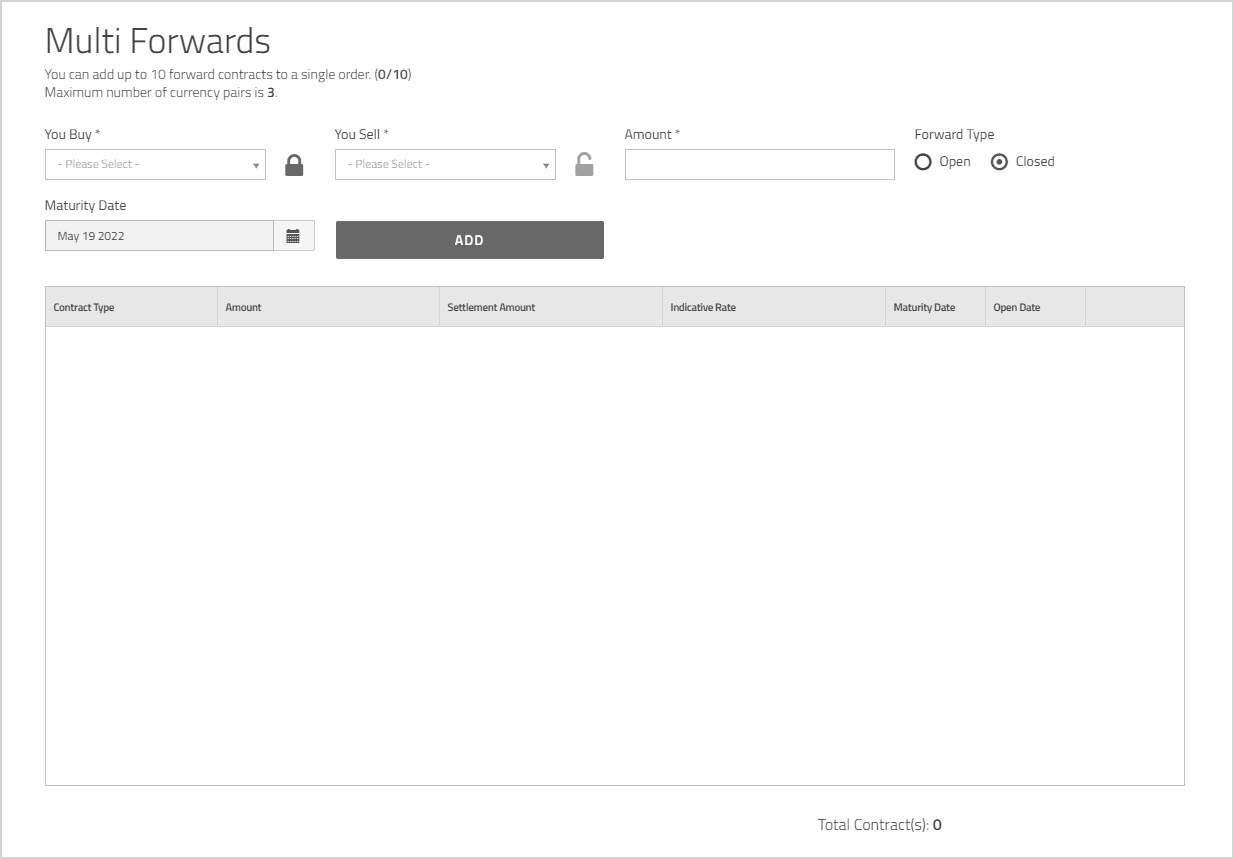

Booking a Multi Forwards order

The way you add forwards to a Multi Forward order is similar to the way you create a single forward. However, the Multi Forwards feature allows you to add up to 25 forwards to a single order, and each order can contain up to three different currency pairs. If you want to book more than 25 forwards or more than three currency pairs, you will have to create more than one order.

As you add each forward to the order, the column in the grid shows you an approximate rate for each forward. The indicative rate gives you an idea of what the final conversion rate will be, so you can decide whether to remove the forward or continue adding more forwards to the order. This is just an estimate, not the final rate. After you add all the forwards to the order and click , you will see live quotes for each forward contract. You can then book all the forwards in the order at the same time.

Note: If you do not book the Multi Forwards order, the information that you entered is lost.

To book a Multi Forwards order

-

In the toolbar, under, click .

The page opens.

- From the dropdown list, choose the currency you want to purchase.

- From the dropdown list, choose the currency you will use to settle the deal. By default, the system selects your base currency for settlement. If you want to use a different currency, you can choose another currency from the dropdown list.

- In the field, enter the amount you want to buy.

- Use the

lock icon to determine how you want your payment to be calculated. The value that you enter in the field is considered to be in whichever currency is locked. By default, the currency is the one that is locked. To change the lock setting, click the

lock icon to determine how you want your payment to be calculated. The value that you enter in the field is considered to be in whichever currency is locked. By default, the currency is the one that is locked. To change the lock setting, click the  unlocked icon and the unlocked icon changes into a locked icon.

unlocked icon and the unlocked icon changes into a locked icon. - In the section, click a radio button to specify whether you want to book an Open Forward or a Closed Forward.

- —Lets you lock in the current exchange rate, and use the funds to make payments within a specified time period. Any drawdown will be valued at the rate agreed upon when you booked the forward.

- —Lets you lock in the current exchange rate and receive funds in a foreign currency on a specified future date (the maturity date). You complete the transaction on the date it matures at the agreed rate of exchange.

- In the field, click the

calendar icon and choose the maturity date.

calendar icon and choose the maturity date.

- If you are booking an Open forward, the is the last date when you can draw down the funds.

- If you are booking a Closed forward, the is the date when the funds become available for you to use.

- If you are booking an forward, you will see an additional field called . This field lets you set the first date that you can start drawing down against the booked forward. Click the

calendar icon and choose the first date you want the funds to be available.

calendar icon and choose the first date you want the funds to be available. Note: By default, the field displays the current date, but you can choose another date in the calendar.

- Click . (If you have already added at least one forward to the order, this button displays .)

The forward is listed in the grid.

Note: If the amount of the forward exceeds your allowed per transaction limit, a message appears at the top of the page to let you know that the amount is over your Per-trade Entry Limit. You will not be able to add the forward to the order. - Repeat steps 2 to 9 to add additional forwards.

Note: You can add up to 25 forwards to a single order. After you add 25 forwards to your order, the button is disabled. If you mouse over the button, you will see a message that lets you know that you have reached the maximum number of allowed forwards. To book additional forwards, create another order. - Click to get a live quote.

The conversion rates and the resulting payment and settlement amounts are displayed. The timer indicates the amount of time you have to book the deal at the displayed rate.

The column heading changes to and it displays the live rate for each forward.

Note: If you don't book the order within the allowed time, the timer displays The column heading changes from to . - To make changes to any of the forwards in the order, or to delete any forwards, click the button to return to the editable grid. Make your changes, then click to get an updated quote. For more information see Editing Multi Forwards and Deleting Multi Forwards.

Note: You cannot edit or delete forwards after the Multi Forward order is booked. - Click to confirm the rates and book the forwards.

Note: If the total value of the forwards violates your daily trade limit, you will not be able to book the order. - Proceed to the section Completing a Multi Forwards order.